What Impact Would Selling Wrigley Field Naming Rights Have on Cubs Payroll?

Wrigley North is getting a new name. With the announcement that their current naming-rights deal will not be renewed, the Brewers have agreed to a new 15-year sponsorship with American Family Insurance that will eliminate Miller from the park’s name. While I am normally not a fan of the unhealthy alliance between baseball and alcohol, I can make an exception for Milwaukee given their team name and the city’s long history with the brewing industry. Losing the Miller connection seems weird.

One of my first thoughts upon hearing the Miller Park news was whether it would reignite discussion of renaming Wrigley Field. After all, naming rights to Wrigley would be quite lucrative and the Cubs are suddenly in a cash crunch. So it bears asking: How much extra payroll would Wrigley naming rights bring?

What are Wrigley naming rights worth?

Twenty MLB parks having naming-rights deals today, with terms of 17 of them publicly available (see first table below). The data for Milwaukee is for the existing 20-year, $41.5 million deal signed in 2000, as financial terms of the new deal have not yet been disclosed.

The average naming deal pays $4.4 million annually, but values are climbing over time and the six most recent deals average $7.8 million annually. The Braves’ $10 million annual deal with SunTrust Bank is the largest we know of over the last decade, but Chicago is a larger media market than Atlanta and the Cubs are (currently) more popular than the Braves. And since ownership would probably not incur the blowback of renaming Wrigley for anything less than top dollar, the Cubs would insist on several million dollars more than Atlanta’s deal.

The largest current deal is the Mets’ $20 million annual pact with Citibank. On the surface, we would expect a deal in Chicago to be smaller than in New York, though the sponsorship in question is a decade old at this point. So I estimate the upper bounds of a Wrigley deal at that same $20 million. By coincidence industry sources estimated the value of Wrigley Field naming rights between $15-20 million annually back in 2012. Let’s suppose the Cubs get the high end of that and continue this exercise.

How much of that $20M would go toward payroll?

Adding an addition $20 million to the annual revenue stream would not instantly increase payroll by the same amount. For starters, the Cubs will have to contribute a chunk of that money to revenue sharing. Exactly how big a chunk we really can’t say. It was only about 12 percent in 2013, but the new CBA formula more heavily weights recent revenue gains (of which the Cubs have had plenty). During this year’s CubsCon, management made reference to 40 percent of new revenue being eaten up by revenue sharing.

Even though I think they were ignoring some of specifics in the accounting, the absolute best-case scenario would see the Cubs only lose 15 percent to revenue sharing. That would result in them keeping $17 million annually, so it could be worse. Since the Cubs, like most teams, typically only spend roughly 50 percent of their revenue on payroll, we’re talking about $8.5 million or so added to the baseball operations budget.

Paying the CBT

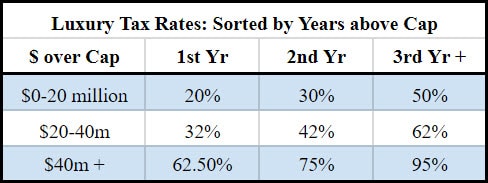

Now comes the luxury tax, aka the competitive balance tax (CBT), which charges teams a hefty penalty for having payrolls above a preset limit. See table below for specific percentages.

The Cubs are already $18 million over the 2019 cap, their first year of penalties. Thus, most of the new naming-rights money allocated to payroll would be taxed in the middle tier at 32 percent. By my iterative calculations, the Cubs would pay a $1.9 million cap hit on this $8.5 million; leaving roughly $6.6 million for actual payroll. Not exactly Bryce Harper money.

Long term, the numbers look even worse. Once the new broadcast network, Marquee, gets going, it will raise Cubs’ revenues beyond their current levels. The current budget already supports a payroll bumping up against the middle luxury tax tier, so one has to imagine a maxed-out budget in the future will certainly reach the highest luxury tier and stay there.

I think we can all agree that if the Cubs are going to rename Wrigley, that money can’t simply be used to line ownership’s pockets. As much of it as possible has to go to payroll. Thus, for this exercise, the $8.5 million in annual revenue is always going to be penalized in the top tax tier at the third year rate of 95 percent. Effectively, that means the Cubs will only be able to add $4.3 million annually to payroll, or the price of a middle reliever.

Yes, the Cubs could occasionally dip below the tax threshold and reset their penalties. But that just means the Cubs will pocket the naming-rights money every third year or so. Not exactly a better outcome. And the current CBA expires at the conclusion of the 2021 season, so the penalties and limits could be vastly different in a few years. Still, we can only operate under the facts we have available to us right now.

Frankly, I do not think a middle reliever is worth the cost of the history and tradition of the Wrigley name. What do you think? Please leave your thoughts and comments below.