Mets to Sign Carlos Correa, Pushing Tax Penalties Beyond Regular Payroll for Many Teams

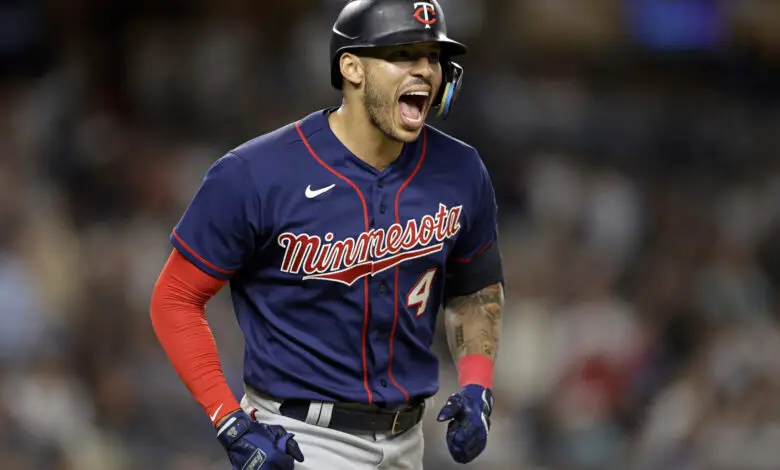

In one of the most shocking turns of events in recent memory, Carlos Correa has flipped coasts and will now be signing with the Mets. The baseball world was thrown into a tizzy Tuesday afternoon when the Giants postponed the press conference to announce Correa’s signing after an issue arose with his medicals. Susan Slusser of the San Francisco Chronicle tweeted that the Giants had flagged something during the physical but that doctors disagreed.

Slusser had previously reported that Correa’s balky back was not the issue, but it’s not known at this point what was. Perhaps the Giants simply got cold feet and needed a reason to back out. Whatever the reason, Steve Cohen’s Mets swooped in with a 12-year, $315 million deal that is lower than the aborted Giants deal in terms of both overall and average annual value.

This confirms the report that the Mets were in on Correa late, and it’s entirely possible the leak of their involvement is what spurred the Giants to fly off the top rope to land the star shortstop. Agent Scott Boras doesn’t negotiate so much as he sets a price and gives teams the opportunity to meet it, hence the Cubs’ failure to even make an offer. The Mets’ previous bid wasn’t enough, but the circumstances have changed just a bit since then.

“We kind of picked up where we were before and it just worked out,” Cohen told Jon Heyman.

Some have questioned whether the Mets will flag something similar in the medicals, but there’s just no way that happens. I mean, have you seen their track record with injured players? Their IL usage makes the Cubs look overly conservative by contrast. Far more important is the understanding that Cohen can’t and won’t allow this thing to stall.

Correa will play third base for the Mets, who already have Francisco Lindor installed at short, and his deal pushes them just shy of $390 million in luxury tax payroll. Their actual payroll is sitting at around $376 million, which is staggering in and of itself even before calculating how much more they’ll pay as repeat CBT offenders.

As a refresher for those who have forgotten or who aren’t familiar with it, the new tax structure is as follows:

- Tier One: $230-250M (20% first time, 30% second)

- Tier Two: $250-270M (32% first, 42% second)

- Tier Three: $270-293M (65% first, 75% second)

- Tier Four: $293M+ (80% first, 90% second)

This means the Mets will be taxed $6 million for the first tier, $8.4 million for the second, $17.25 million for the third, and a whopping $85.86 million for tier four. That’s around $117.5 million in taxes, which is more than 10 teams spent on their entire actual payroll in 2022. Because they have exceeded the threshold by $40 million, they will also see their highest pick in next summer’s draft move back 10 places. And to think this is a team that was reluctant to part with any top prospects to land Willson Contreras in a bid to bolster their playoff run.

While I applaud Cohen for holding both middle fingers up to almost every one of his colleagues who are still managing to perpetuate the lie that baseball doesn’t make money, I have to laugh at the contradiction created by their prospect-hugging. As much as I hate to see the Mets succeed, seeing them hoist the commissioner’s piece of metal at the end of the season would provide justification for what they’re doing. Seeing them Mets things up, on the other hand, would allow Tom Ricketts and others to rest on their “dead money is bad money” laurels.