Predicting Future Cub Payrolls (Part 4): Four-Year Predictions on How Much Cubs Can Spend

In parts 1-3 of this series (all linked below), I have laid out all manner of financial information about the Cubs. Now *cracks knuckles* I intend to use this information to predict future Cub payrolls.

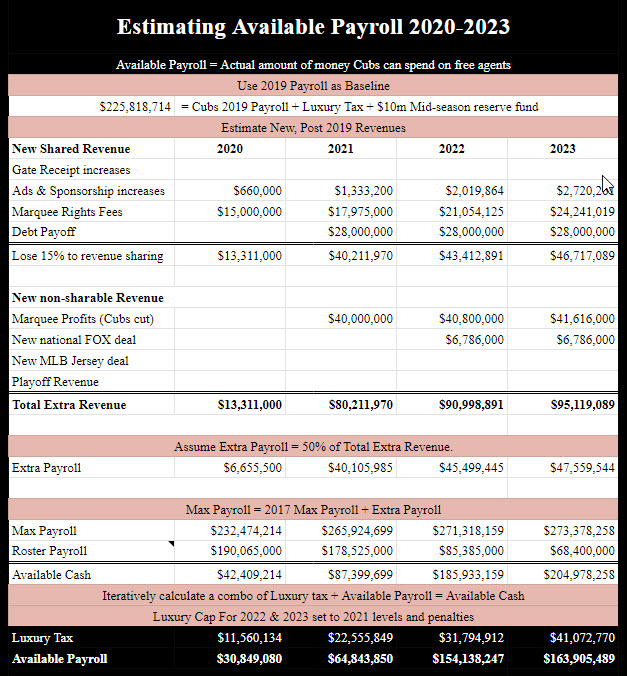

According to Tom Ricketts, the Cubs did not pursue any big agents for 2019 because there was no more to spend. This provides me an opportunity to improve my predictions since I no longer need to rely on Forbes revenue numbers, which are guesswork to begin with. Instead, I can take 2019 as a baseline. If the Cubs have truly spent every available dollar this season (which I established was believable in Part II) then future payrolls can be predicted by merely adding 50% of any new revenues that arise in 2020 and beyond to this baseline.

Helpfully, there are no longer a larger number of new revenue streams arriving each year. Virtually all of the Wrigley renovation is complete. New revenue from the premium clubs and endorsement deals are already baked into 2019 payroll. As I see it there are only eight new revenue streams to consider:

- Future ticket price increases

- Future in-park advertising rate increases

- Playoff revenue

- Debt payoff

- Marquee rights fee

- Marquee profits

- Cubs’ share of new FOX-MLB TV deal starting in 2022

- Cubs share of new Nike-MLB jersey deal

Thus, Cubs Insider is proud to introduce this spreadsheet to track any information or estimates on these revenue streams (screenshot below). The most important number in this sheet is the final line: “Available Payroll.” This amount represents my current estimate of how much cash the Cubs can spend on free agents each year.

By way of explanation, the 2019 Cubs are being paid a little under $210 million in total salary. As such, the team is $28.5 million over the luxury cap and will need to pay a $6.5 million penalty. I also expect management has retained a $10 million reserve fund for mid-season acquisitions as they have done in each of the past three seasons. By combining these three numbers, I calculate the Cubs will spend $226 million in 2019 payroll. By their own account, this is everything they can afford.

The spreadsheet contains line items for each of the new potential revenue streams that could add to this $226 million total. Ticket prices will remain empty until next year’s figures are announced. Playoff revenue represents revenue from the preceding season’s playoffs and will be updated at the conclusion of each postseason.

Advertising and sponsorship figures are based on a 2% annual increase from a base number obtained from assorted sources. The $28 million previously allotted to annual debt service is returned to revenue starting in 2021, as I presume the Cubs will have paid off their debt by then.

I discussed Marquee rights fees and profits extensively in Part III of this series. To summarize, Crane Kenney, Cubs president of business operations, recently explained that the Cubs have a new rights deal in place with Marquee that represents a substantial increase over current money and would be available for payroll use in 2020. Kenney also explained that profits from Marquee’s carriage fees were more speculative but could account for much larger profits down the road.

As a result, my spreadsheet adds rights-fee revenue starting in 2020, but does not add Marquee profits until 2021. Effectively, the Cubs will spend Marquee profits in the following year, much as playoff revenue is budgeted to the following year.

I estimated that the Cubs could have obtained a 20-25 year rights fee deal on the open market with a $120-140 million average annual value, based on recent similar TV deals. That led to a hypothetical 25-year, $3.3 billion contract ($132 million AAV) that pays the Cubs $85 million in 2020, with 3.5% annual increases thereafter. This will serve as a proxy contract until the details of the real deal leak out. Since the Cubs’ current rights deals pay about $70 million in 2019, this new deal represents $15 million in additional revenue in 2020.

Regarding Marquee profits, Sinclair announced it expects $40 million in annual profits from its share of the network. To be conservative, I am assuming the Cubs have a 50/50 partnership with Sinclair and would be entitled to an equal $40 million. Kenney stated that the business side would not release these funds to the baseball side of operations until they felt comfortable that the revenues were sustainable.I have not allotted Marquee profits for use until 2021. I also assumed annual profit increases of 2%.

In 2018 MLB negotiated a seven year extension to its TV deal for various post-season games and various other broadcast rights. The deal raises FOX’s annual payments from $525 million annually to $728.6 million, a $203.6 million dollar annual increase, starting in 2022. The Cubs are entitled to a 1/30th share of this deal. I therefore divided 203.6 by 30 to obtain a $6.79 million revenue increase starting in 2022.

MLB also recently negotiated a new jersey deal with Nike (after Under Armour backed out on a proposed deal) that will start in 2020. Financial terms have not yet been revealed, thus I do no yet know how much additional revenue this deal will generate.

Finally, I assumed that the 2021 luxury cap and penalty structure would remain in place in 2022 and 2023 so that I could calculate hypothetical luxury tax payments. In reality a new CBA will be negotiated in 2021 and the real luxury cap (if it still exists) will likely be higher, with new penalties.

Our spreadsheet also contains two additional tabs, showing payroll over the next five years. The tab marked “5 Year Payroll,” tracks actual dollars being spent on payroll each season. Signing bonuses and salaries represent the actual cash being paid to each player by calendar year, to provide an accurate summary of cash outlays each year. The 5 year payroll sheet also provides predicted arbitration salaries for all arbitration eligible players, updated monthly based on in-season performance. This, in combination with existing contract data, allows Cubs Insider to maintain an accurate prediction of future Cub salary obligations.

The tab marked “cap space” tracks the same data, but uses average annual values (AAV) to provide accurate, up-to-date, numbers on the Cubs cap space every year.